It is specifically designed to keep individuals and families out of poverty while encouraging people to work. The maximum credit depends on the number of qualifying children you claim on your return.

What Is The Earned Income Tax Credit Overview Exceptions More

What Is The Earned Income Tax Credit Overview Exceptions More

The business application guide explains the process of applying.

How does eitc work. To figure the credit see Publication 596 Earned Income Credit. Tax Return for Seniors. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020.

The EITC allows working families to keep more of their earned income. If the you are claiming the EITC with a qualifying child you must also complete and attach the Schedule EIC Earned Income. The amount of EITC benefit depends on a recipients income and number of children.

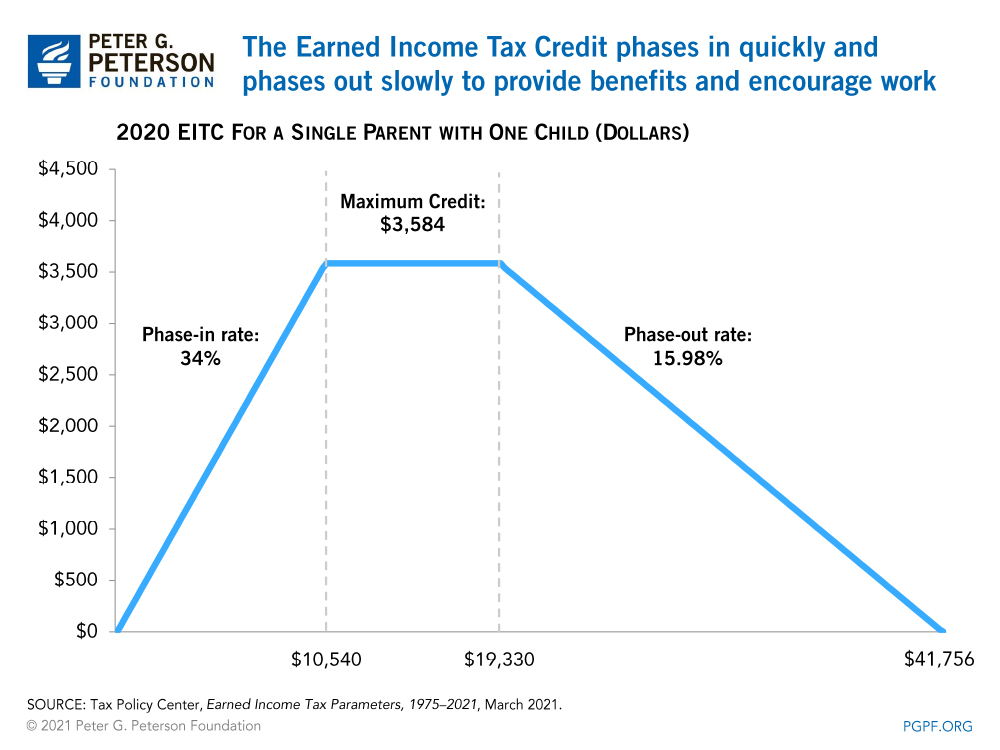

DCED will no longer require applicants to mail the signed signature page. As noted a workers EITC grows with each additional dollar of earnings until reaching the maximum value. In 2019 25 million taxpayers received about 63 billion in earned income credits.

Pennsylvania businesses can begin applying for EITC credits through DCEDs electronic single application system. In 2020 the earned income tax credit EITC will provide maximum credits ranging from 538 for workers with no children to 6660 for workers with at least three children figure 1. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children.

What is the Earned Income Tax Credit. Learn more about how they work in this informati. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

The EIC provides support for low and moderate-income working parents with qualifying children in the form of tax credits. During 2019 25 million taxpayers received about. Earned Income Tax Credit EITC Relief If your earned income was higher in 2019 than in 2020 you can use the 2019 amount to figure your EITC for 2020.

The EITC is the single most effective means tested federal antipoverty program for working-age householdsproviding additional income and boosting employment for low-income workers. The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. The Earned Income Tax Credit - EITC or EIC - is a refundable tax credit aimed at helping families with low-to-moderate earned income.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. The EITC is designed to reward work. Through EITC tax credits.

This year the EITC is getting a second look from taxpayers because many have experienced income changes due to COVID-19. To claim the EITC taxpayers need to file a Form 1040 US. How Does the Earned Income Credit Work.

How can individuals or businesses in Pennsylvania support schools they care about. Individual Income Tax Return or Form 1040-SR US. The EITC is a significant tax credit for lower and lower-middle income taxpayers that rewards earned income particularly for those with children.

It was first enacted under the Ford administration in 1975 and was built with the dual purpose of incentivizing the earning of income and reducing poverty. We explain in 3 minutesSummary. This creates an incentive for people to join the labor force and for low-wage workers to increase their work hours.

Tax credit applications will be processed on a first-come first-served basis by day submitted. How do I claim the EITC. The IRS has a.

This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020. The EITC is a refundable credit meaning it can reduce your tax liability to zero and youll receive any remaining credit in the form of a tax refund. How does it work.

The tax credit is not as beneficial for individuals without children. The Earned Income Tax Credit EITC is a tax credit available to working Americans with low incomes.